Custom Software To Automate & Streamline Financial Planning Workflows

Overview

Edge Financial Planning is a Melbourne based firm focusing on increasing the financial position of hundreds of Australian families. As a small business, the company relied on many off the shelf tools to support their business processes. These systems were not developed with a focus on the financial world, leading to extensive time investment and an excessive cost overhead in an already competitive marketplace. The company embraced a Vokke software solution, showing them the state of their business in a centralized location. This decision allows Edge Financial Planning to focus more on what matters – customers, quality and sound advice – and less about the management of information.

The Problem

Financial planners, paraplanners, client services managers and researchers were each spending hours a week trying to understand the current position of their client portfolio. Each client would move through an extensive, long running workflow involving expertise from team members and outside departments. Edge relied on third party software solutions which were not targeted for their exact needs; as such, information was often replicated across systems by hand, open to human error, difficult to update, and shielded from necessary analytical insights.

Edge Financial Planning was operating like most businesses, where the team spends a large portion of their time simply keeping the business position up to date. Like most situations, Edge gained leverage on their unique processes by a custom automation solution.

The Solution

After a consultation with a business analyst, a solution was drafted that would automate their daily business tasks. An integrated, centralised cloud solution was developed adopting the unique processes of the company, moving tedious tasks onto the cloud. For the first time, team members can work remotely via a secure cloud service and have a real time, up to date picture of their client workflows. This solution gives Edge a unique advantage in their industry.

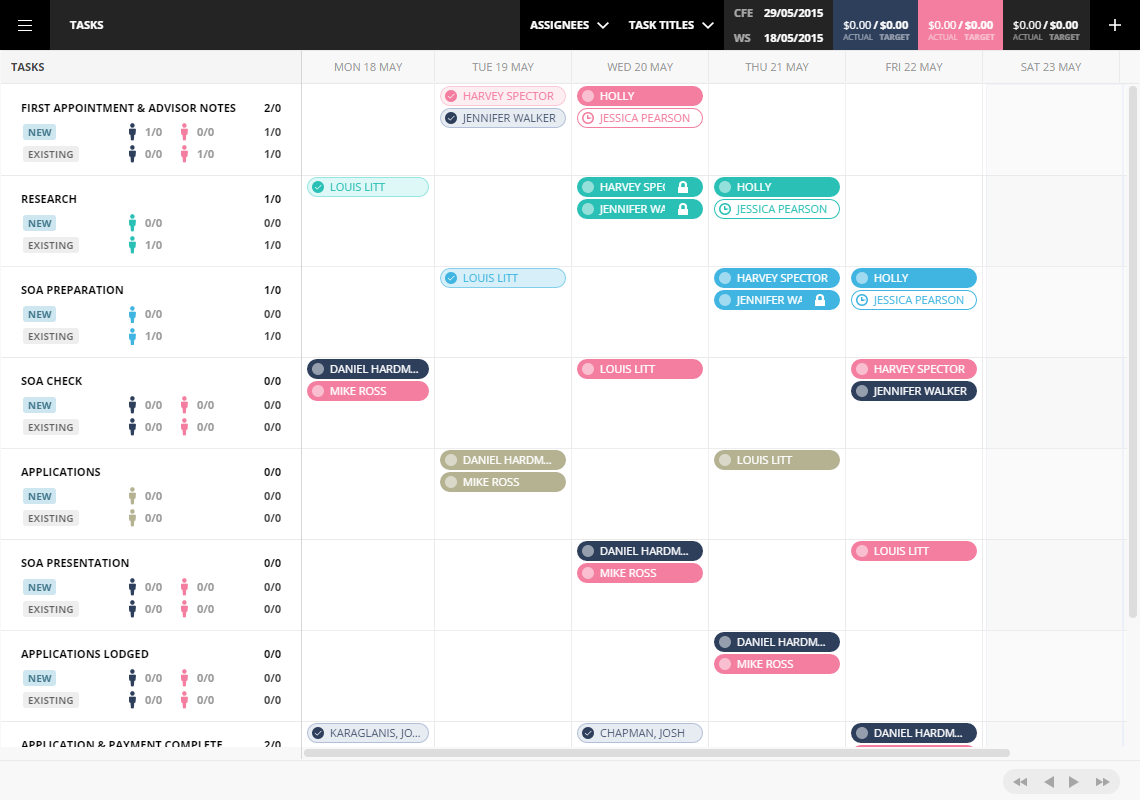

- A unique workflow board was developed

Clients and workflows are no longer text, or cells in an Excel spreadsheet, but are now cards on a board. Workflows can be updated by a simple drag and drop, with business rules specific to their practice dictating the allowed changes and financial consequences

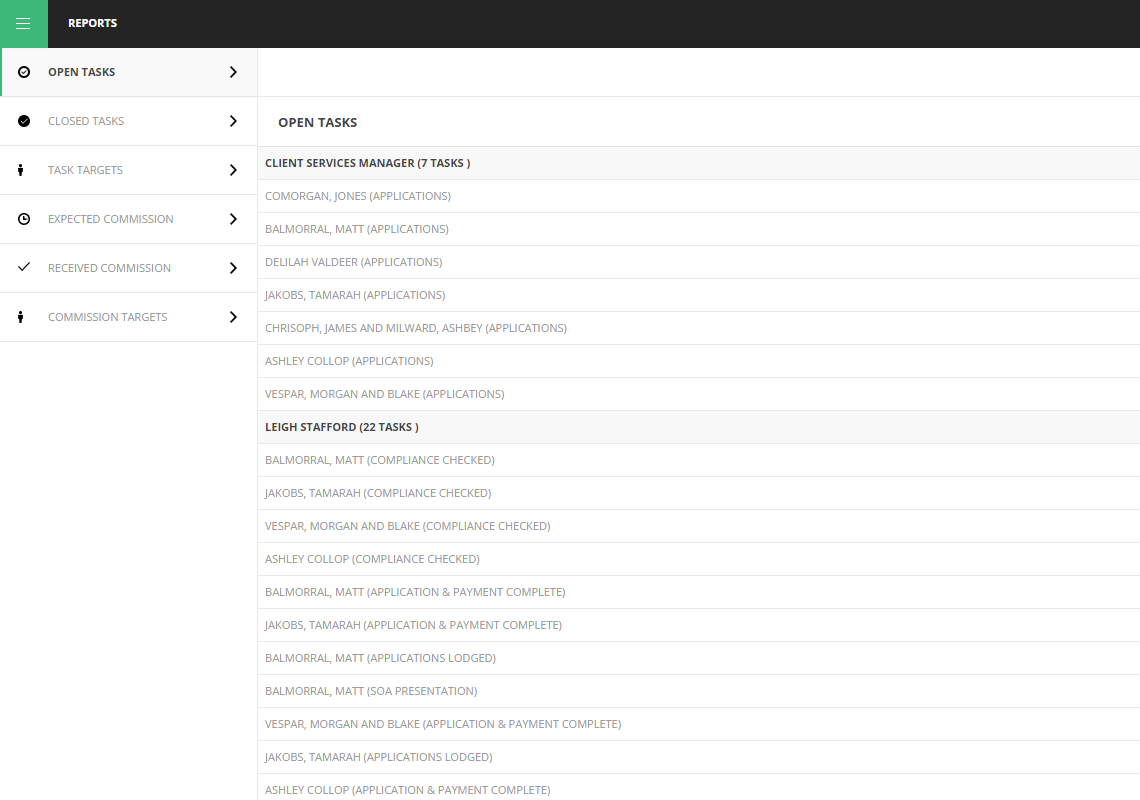

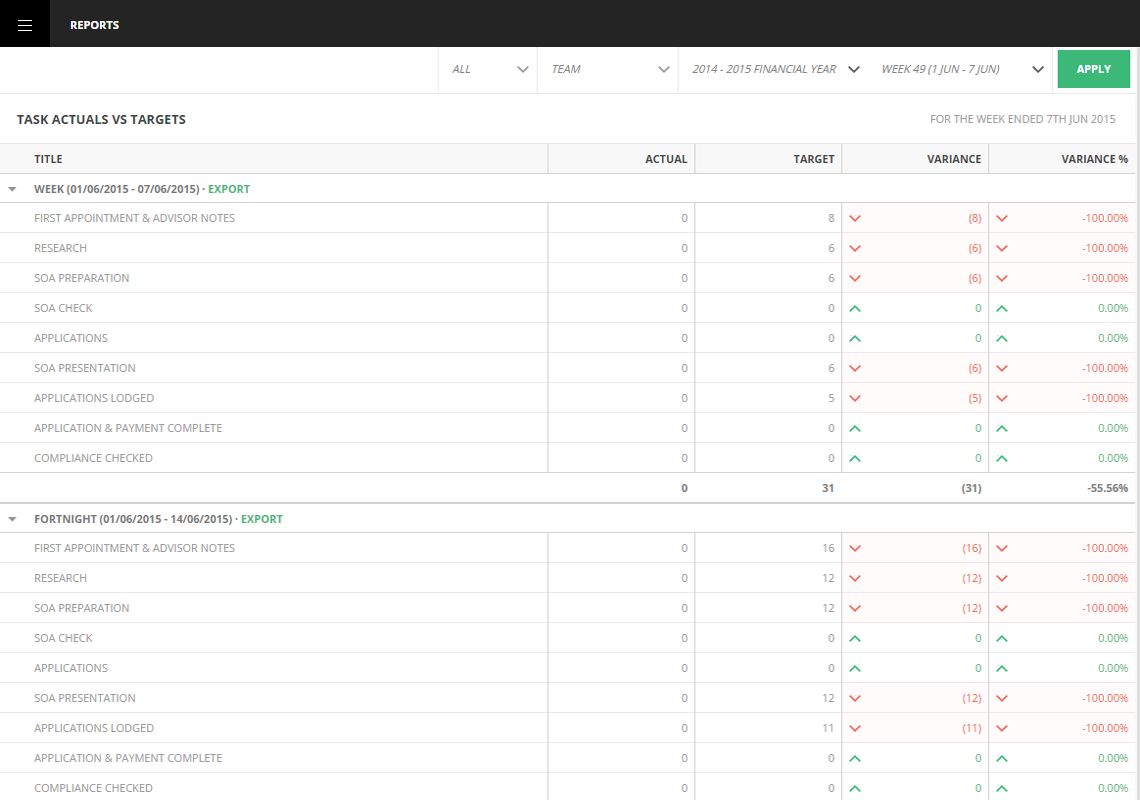

- Reporting and analytics were integrated

Advanced realtime and retrospective reporting was added, allowing the company to observe key performance indicators and critical business metrics. These reports can be easily customized for any team member, financial year, or any other business property. These reports support exporting to Excel for further analysis.

- Developed using the cloud

Business owners and employees are now more than ever embracing the concept of remote teleworking and mobility. As such, the custom solution was designed to be placed on the cloud. - Team member targets were developed

Team members had unique personal goals for each week within their business. These goals were integrated deeply into the system, allowing for performance reporting of a specific team member or the company as a whole.